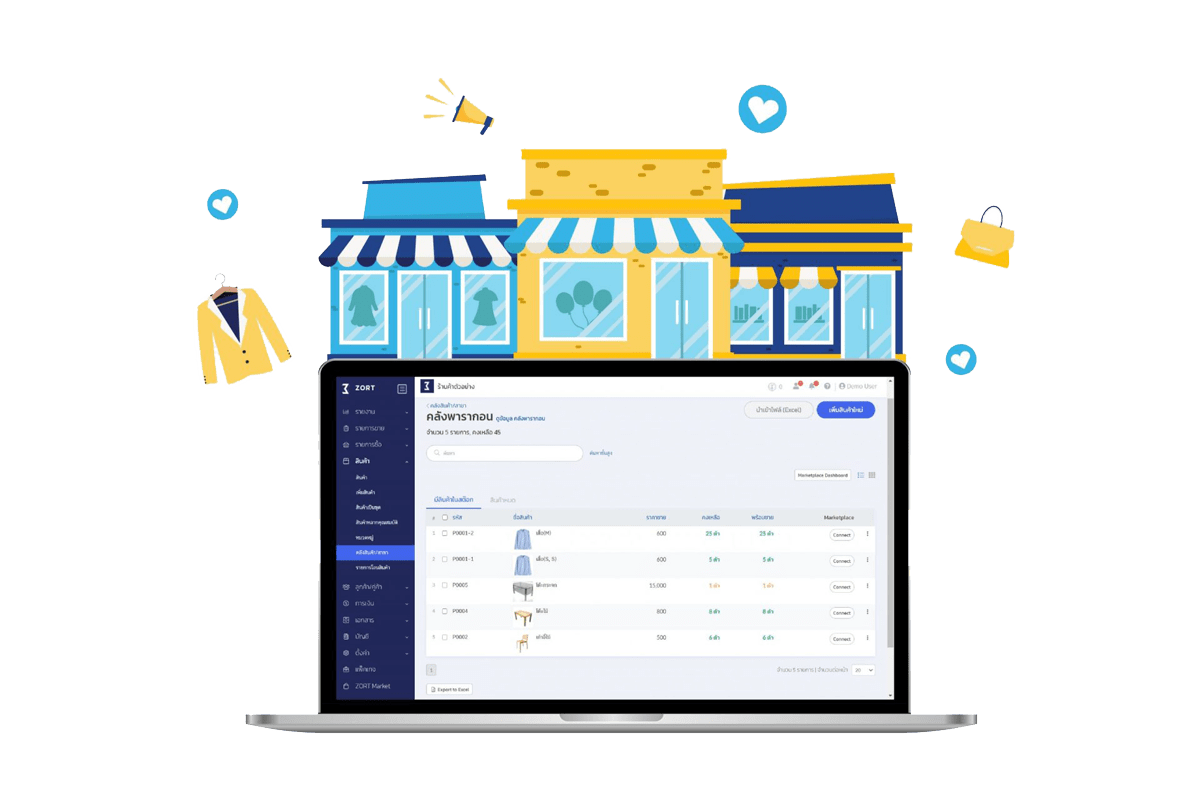

Consignment System

Consignment System is one of the products sales, consigning the brands or shop’s products, but the product ownership remains with us until the products are sold. The selling shops would receive the consignment commission as agreed. One of the problems of the consignments is an inability to track the income in real-time, resulting in the delayed stock management. As the consignment has the different accounting processes from the other methods, the sales management might not be as effective as it should be. However, those problems would be solved when you use ZORT’s consignment system with the following functions

Track Products from All Branches from One Place

- No matter how many shops are branches you consign, the management is made easy with the ZORT’s feature ‘Inventory/Branch System’. The system enables you to track the product stock’s movement immediately from one place, compatible with department store consignment and other shops

Check Stock Anywhere

- Our product consignment system helps your consignment easier as you could check the stock for each branch anywhere and manage all branches’ stocks in one place. No need to waste time going to the shop or check the stocks branch by branch

Helps you better plan the business and product consignment

- See the monthly summary report together with actual product sales amount, making your billings easier by the program specially designed for the consignment system. You will know the insights for business planning, where to consign, what to consign, including what NOT to consign. In addition, you could estimate the product quantity for consignment more accurately

Convert Report to Excel File

- One of the sales data reports that you could easily analyze and use, is recording in Excel format. ZORT’s system could immediately convert each branch’s sales amount to Excel file, and easily used for other applications

Easy for Accounting Record and Tax Preparation

- As mentioned before, consignment differs from normal product sales in accounting perspective. The seller needs to issue tax invoice and submit taxes to the revenue department by self. If you have the detailed trading information, tax accountings will be easier