For stores using the VAT/ NO VAT feature for bundled products in the ZORT system, you can configure the tax settings in the bundled products menu. Follow these steps to create bundled products with VAT or NO VAT:

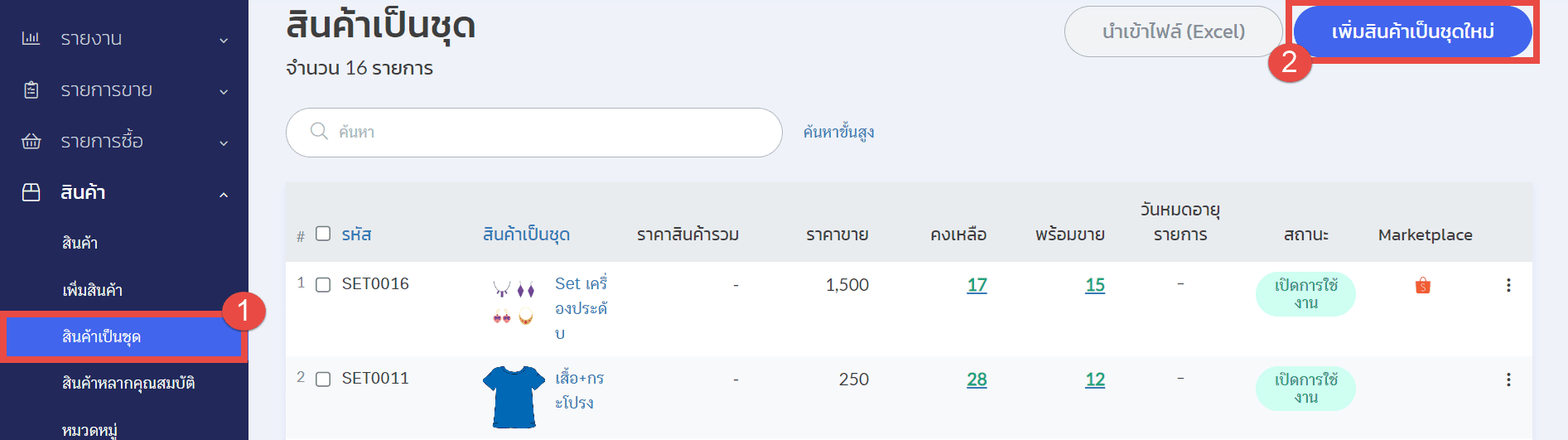

1. Go to the “Inventories” menu and select the “Bundles” section.

2. Click “Add Bundle.”

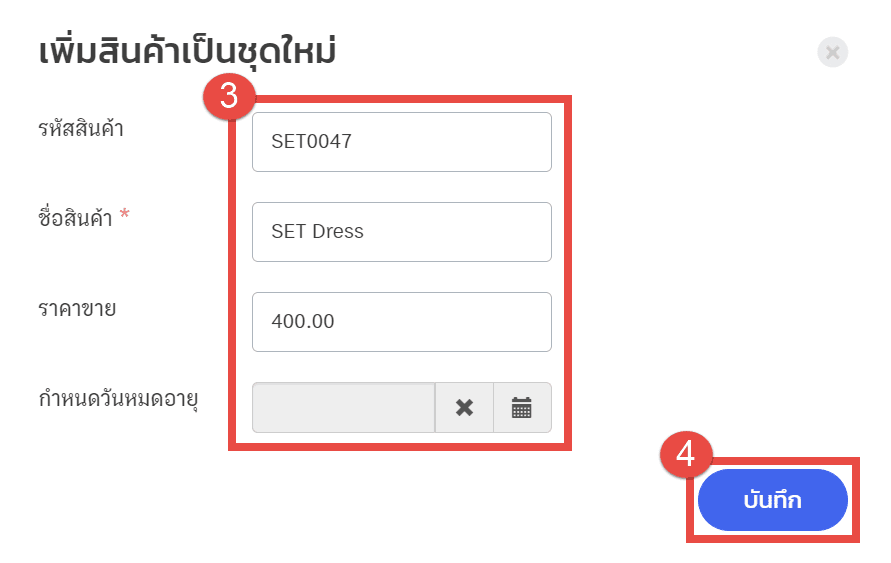

3. Fill in the product name and sale price. For promotional bundles, you can set an expiration date.

4. Click “Save.”

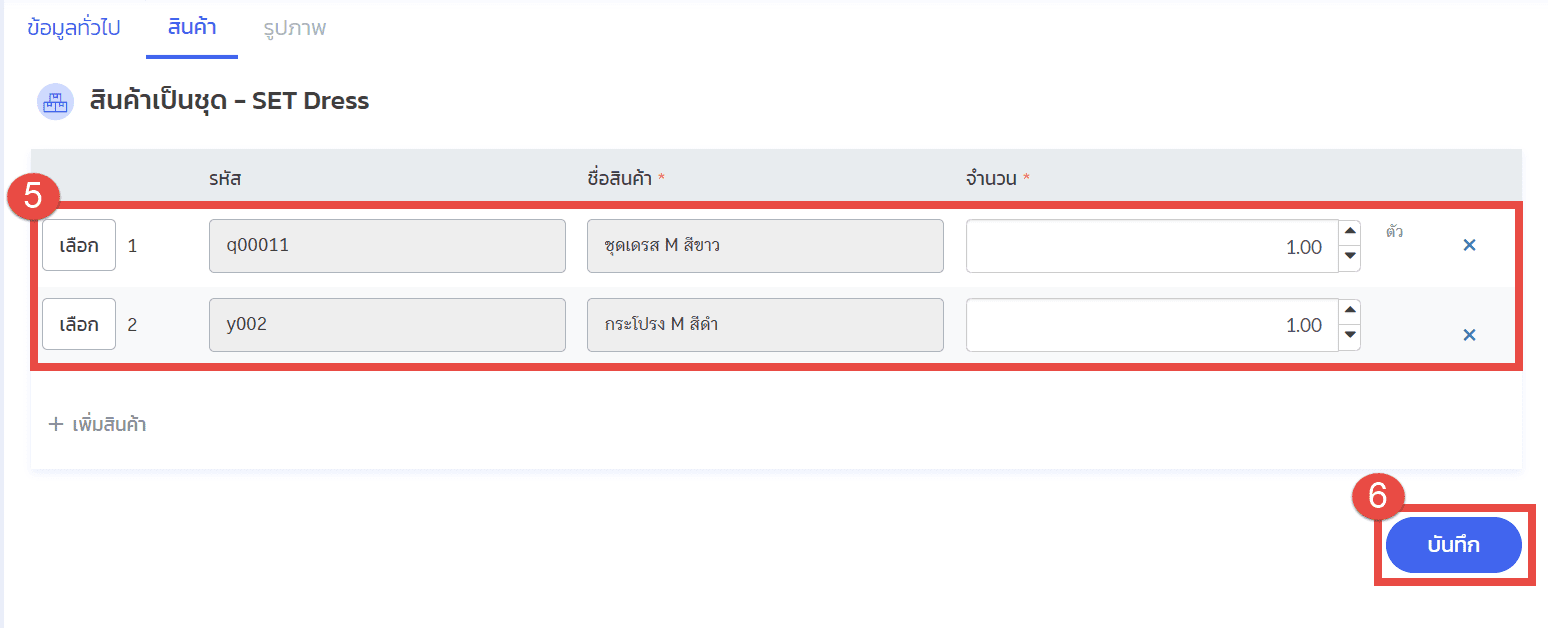

5. Select Products to Include in the Bundle.

6. Click “Save.”

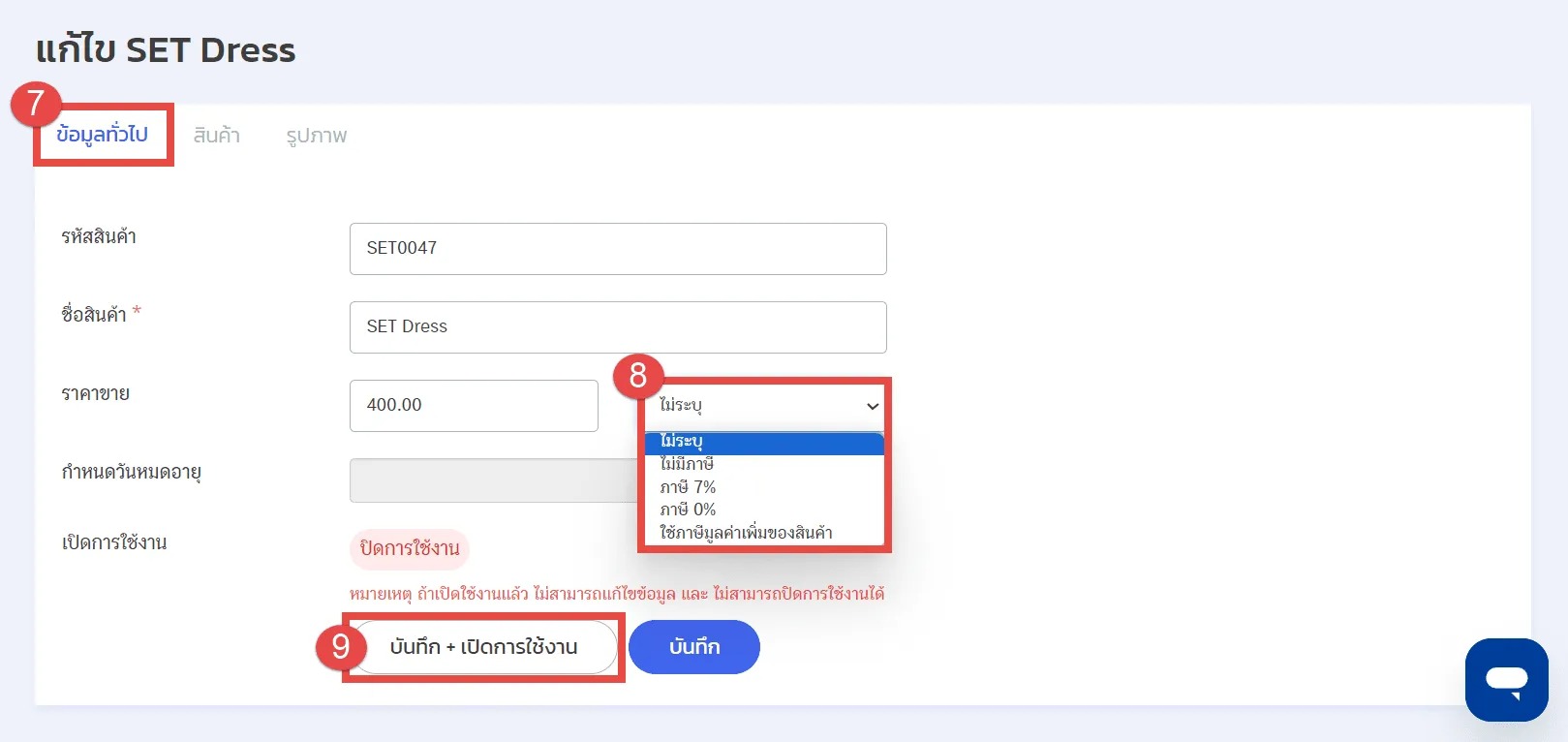

7. Go to the “General Information” Section

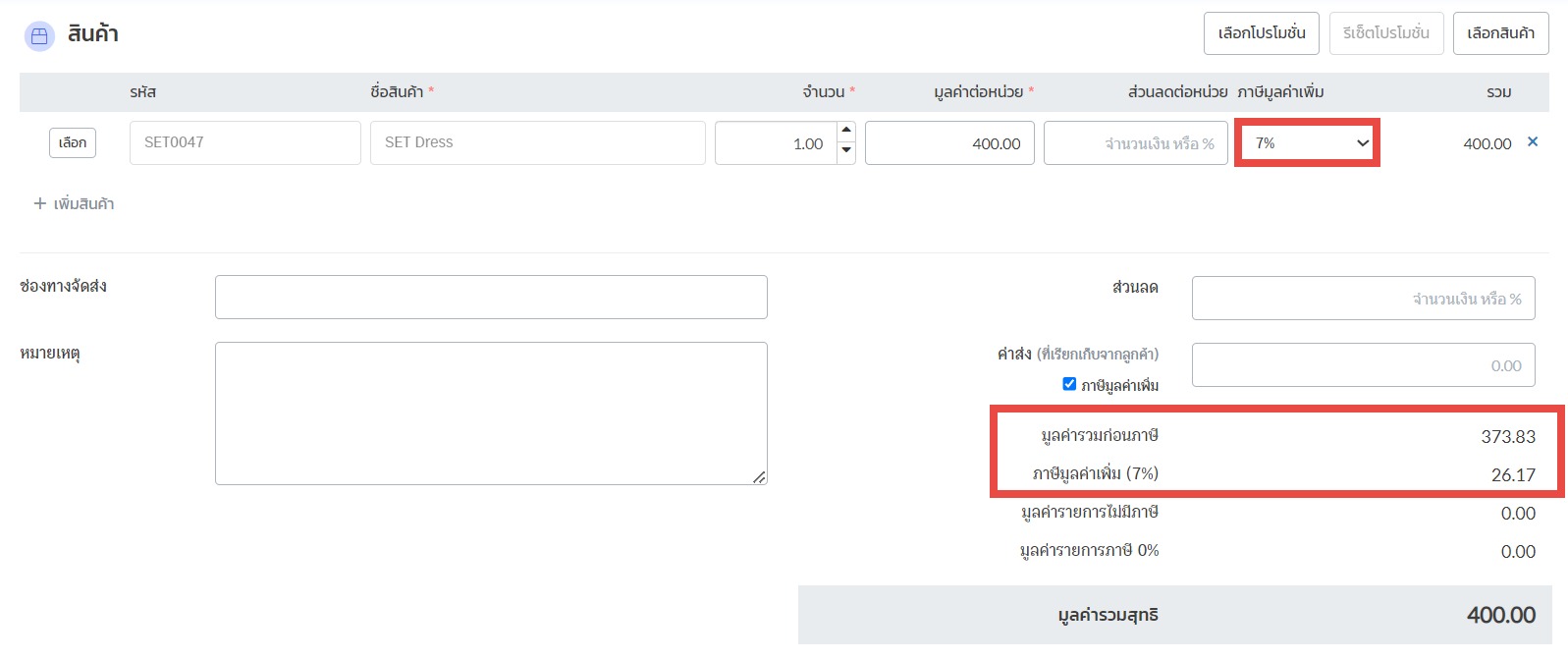

8. Select the Tax Type. The tax calculation will apply only to this bundled product:

- Not Specified: The bundle will display “Not Specified” for tax when creating sales orders.

- No VAT: The bundle will display “No VAT” for sales orders.

- 7% VAT: The bundle will display “7%” VAT for sales orders.

- 0% VAT: The bundle will display “0%” VAT for sales orders.

- Use VAT of Products: To use this option, you must first set the tax type for the individual products in the bundle. Refer to the guide on creating products with VAT/ NO VAT for details.

9. Click “Save + Activate.” If you click “Activate,” you can only edit the product code, name, sale price, tax type, and expiration date afterward.

By following these steps, you will ensure that the tax calculations for bundled products align with your business needs.

If you are interested in utilizing our comprehensive store management system,

we encourage you to reach out for further information.

Please do not hesitate to contact us at:

Phone: 02-026-6423

Email: support@zortout.com

LINE: @zort