The VAT/ NO VAT function is ideal for businesses selling both taxable and non-taxable items, such as agricultural products and pet supplies. To utilize this function for various transactions in the ZORT system, follow these steps:

VAT/ NO VAT Applies To:

1. Purchases

2. Orders

3. Product Returns

4. Returned Products

*This guide focuses on creating sales transactions.

1. Go to the “Orders” menu and select “Orders”.

2. Click “Add Order.”

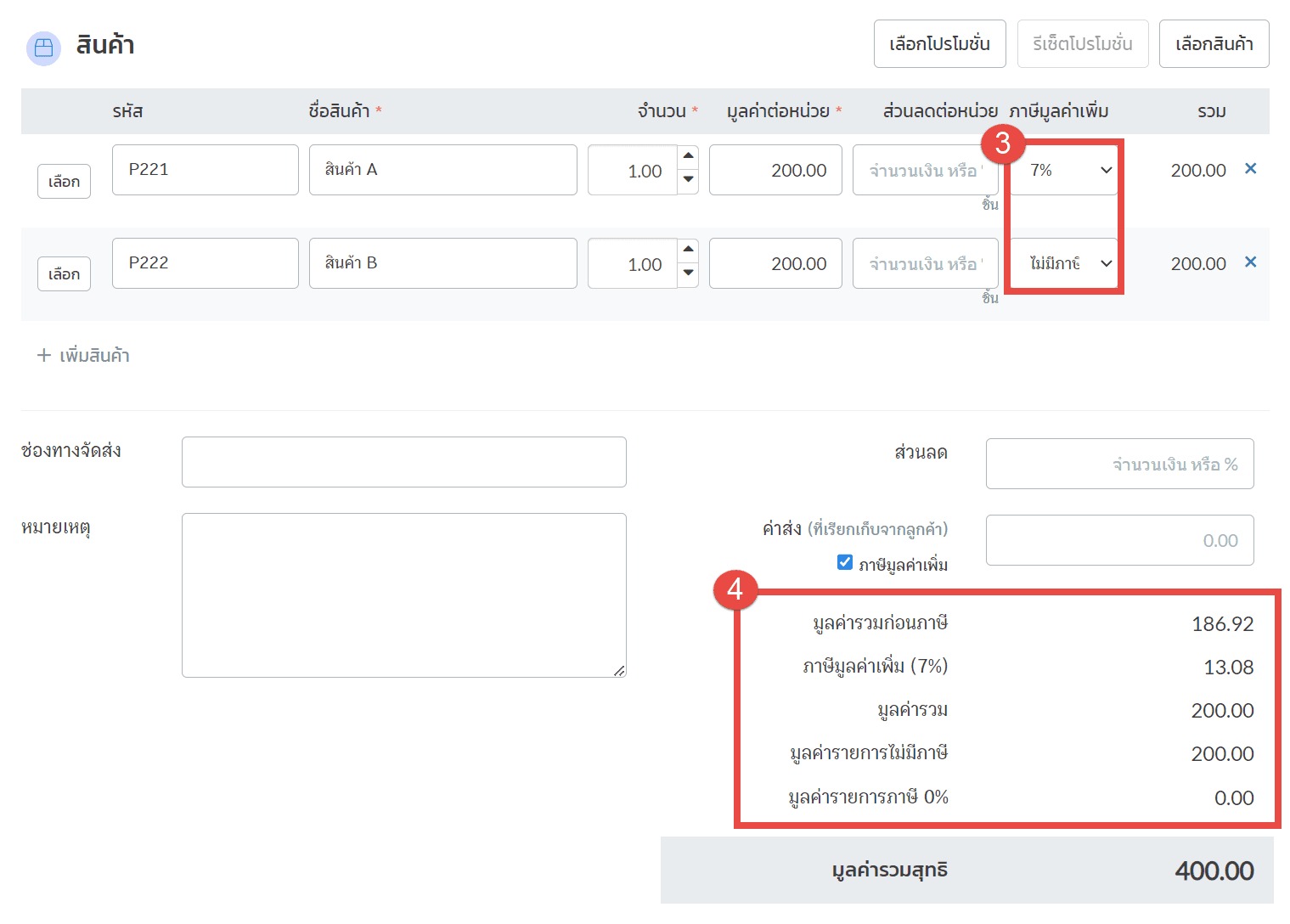

3. Choose the items to include in the order.

4. The system will calculate the tax based on the selected products and their tax types.

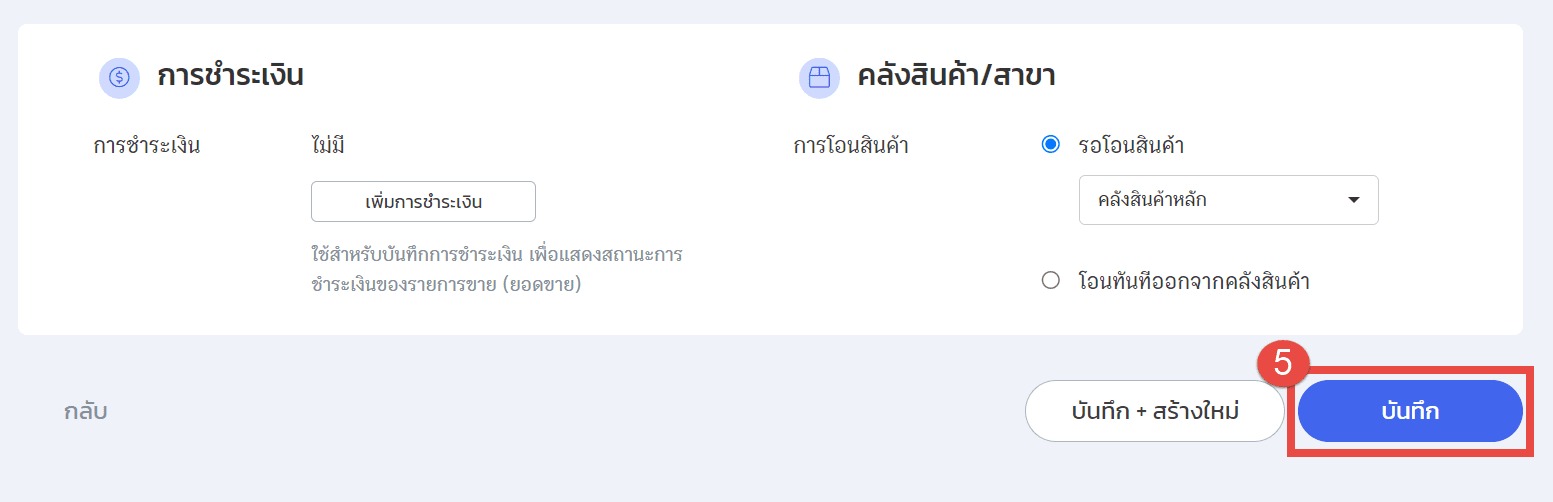

5. Complete the necessary details and click “Save”.

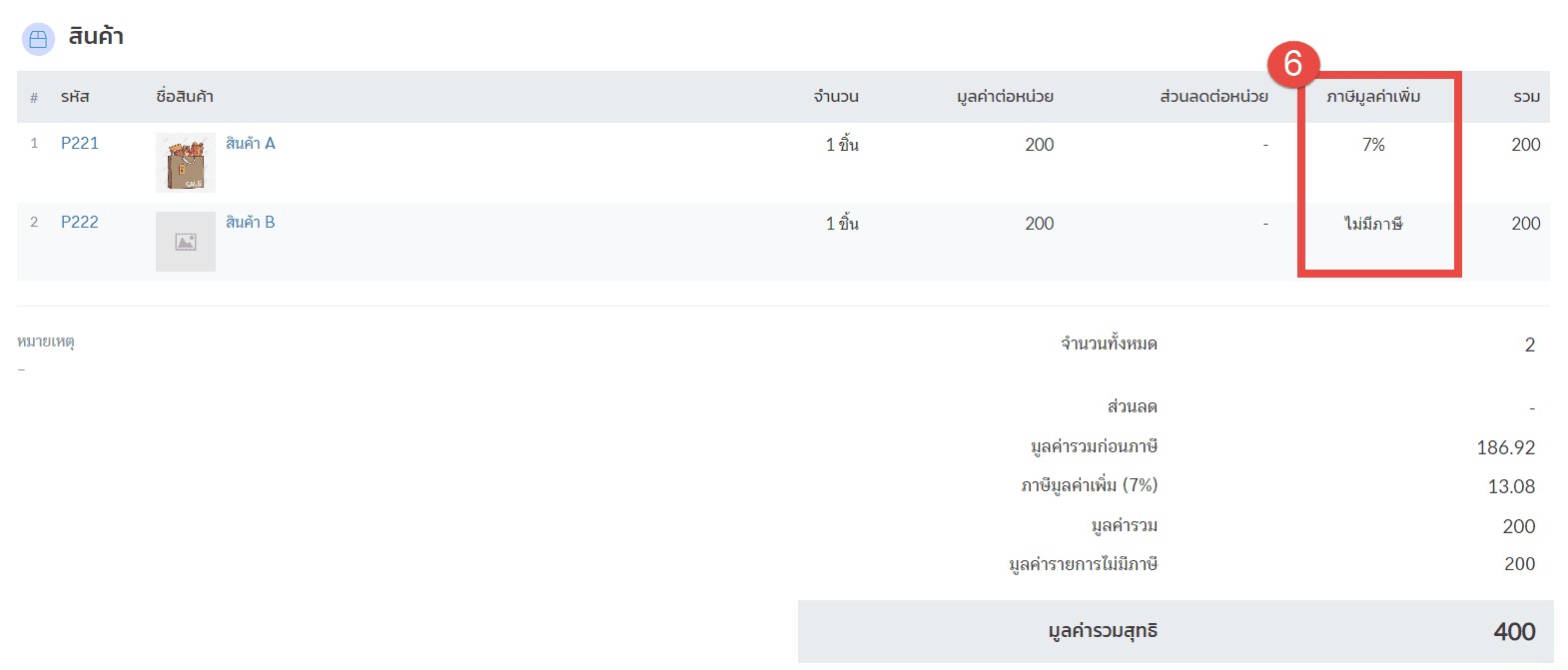

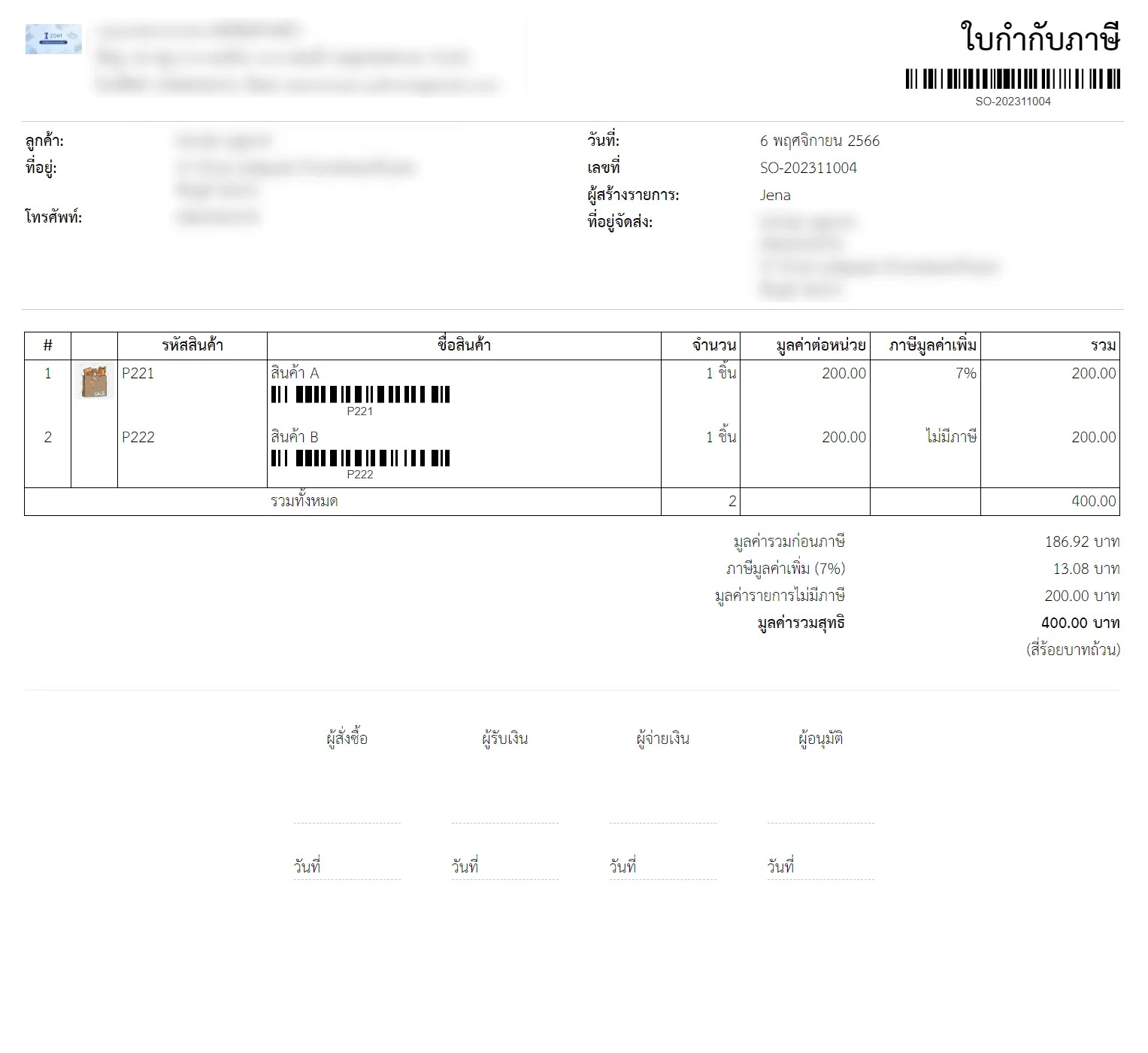

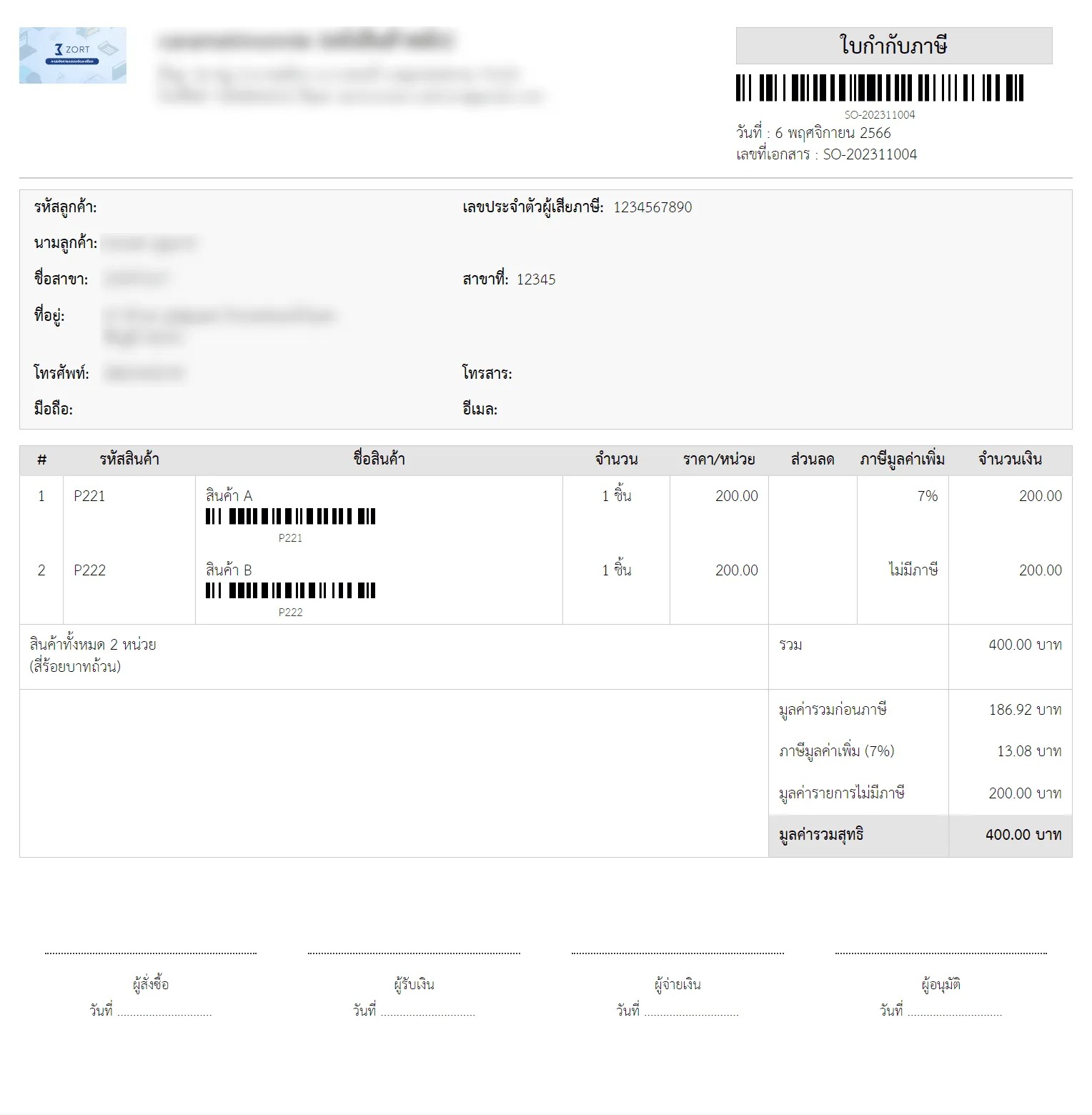

6. The order will display, including a tax column.

VAT/ NO VAT Calculation Methods #

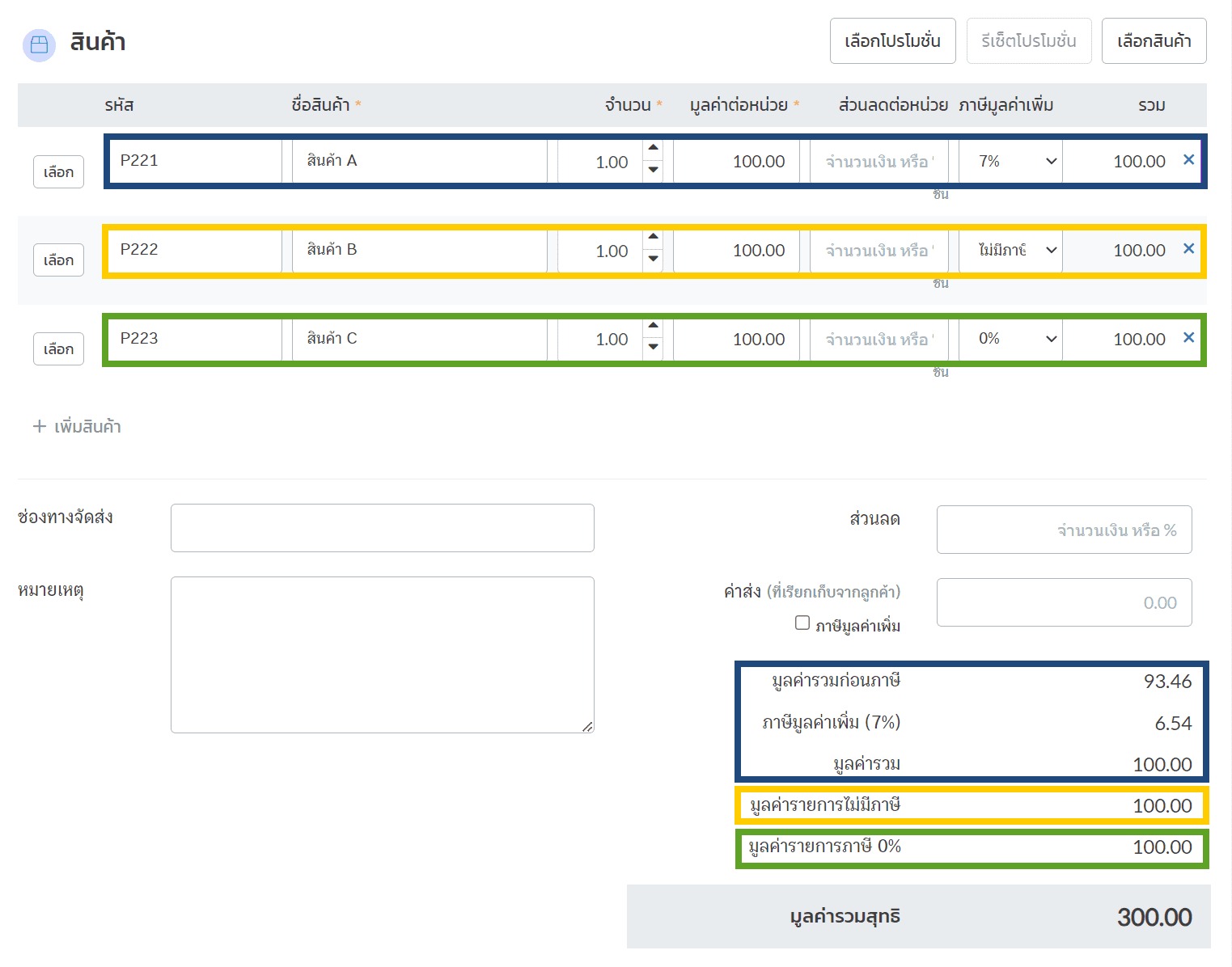

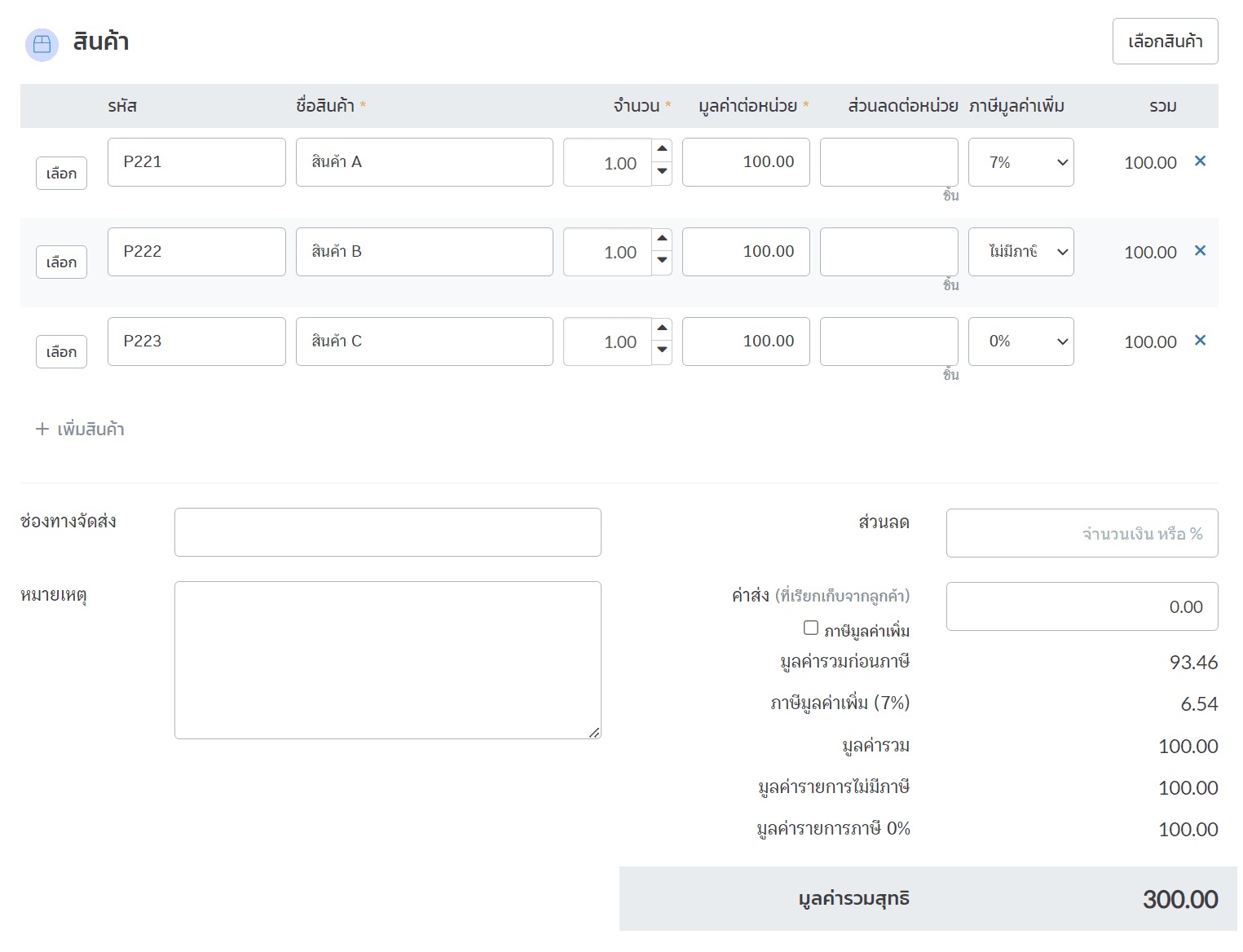

1. Standard VAT/ NO VAT Calculation

Example: Sale of Product A (100 THB, 7% VAT), Product B (100 THB, No Tax), Product C (100 THB, 0% VAT).

- Blue: VAT items will be calculated in the “Value Added Tax (7%)” column. E.g., Product A: VAT 7% = 6.54 THB; Pre-tax value = 93.46 THB; Total = 100 THB.

- Yellow: Non-taxable items will show in the “Non-Taxable Value” column. E.g., Product B: Non-taxable value = 100 THB.

- Green: 0% VAT items will show in the “0% VAT Value” column. E.g., Product C: 0% VAT value = 100 THB.

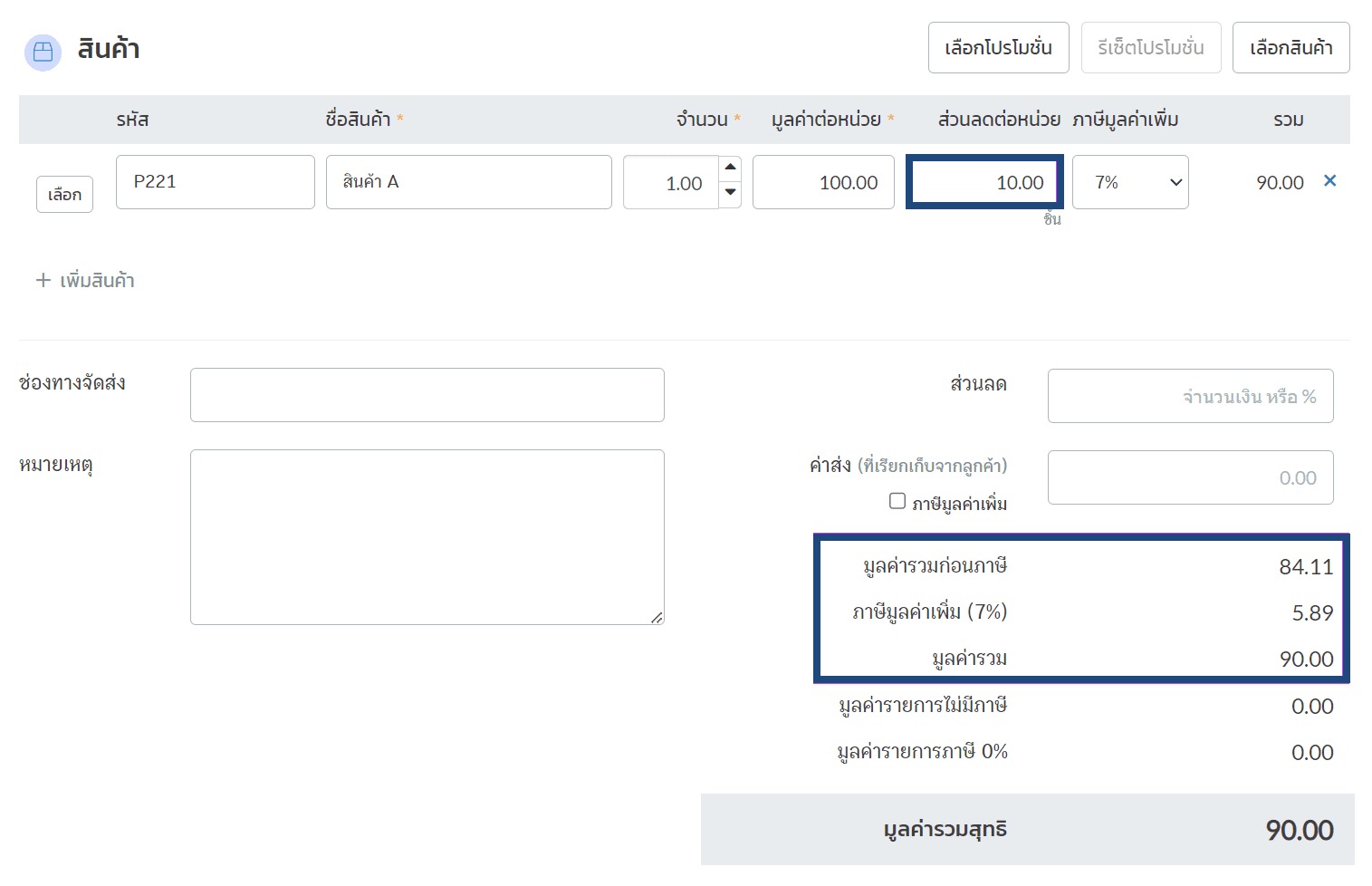

2. VAT/ NO VAT with Per-Unit Discounts

Example: Product A (100 THB, 7% VAT) with 10 THB discount per unit, resulting in a total of 90 THB. Tax is calculated on the discounted amount. E.g., VAT 7% = 5.89 THB; Pre-tax value = 84.11 THB; Total = 90 THB.

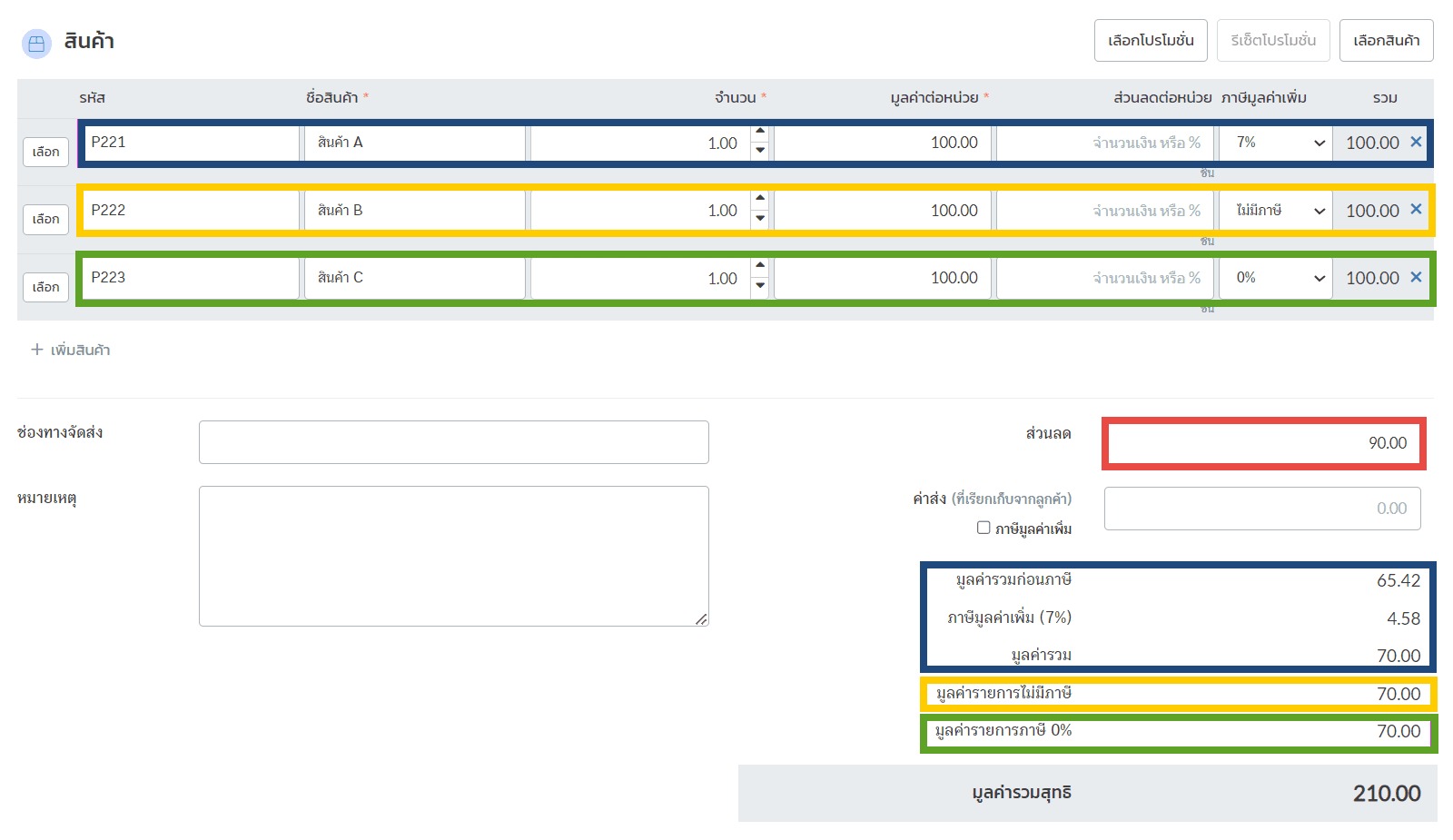

3. VAT/ NO VAT with End-of-Bill Discounts

Example: Sale with 3 items (100 THB each) and an end-of-bill discount of 90 THB. The discount is averaged across items:

- Product A: 100 THB – 30 THB = 70 THB (VAT 7% = 4.58 THB; Pre-tax value = 65.42 THB; Total = 70 THB).

- Product B: 70 THB (No Tax; Value = 70 THB).

- Product C: 70 THB (0% VAT; Value = 70 THB).

The system will calculate the tax based on the amount after the final bill discount. In this example, the calculation is based on a total of 70 THB.

For instance:

- Blue: Product A has a price of 70 THB after the final bill discount. The system calculates 7% VAT as 4.58 THB, the amount before tax as 65.42 THB, and the total amount as 70 THB.

- Yellow: Product B has a price of 70 THB after the final bill discount. The system shows the item value as 70 THB without tax.

- Green: Product C has a price of 70 THB after the final bill discount. The system shows the item value as 70 THB with 0% tax.

- Red: Final bill discount of 90 THB.

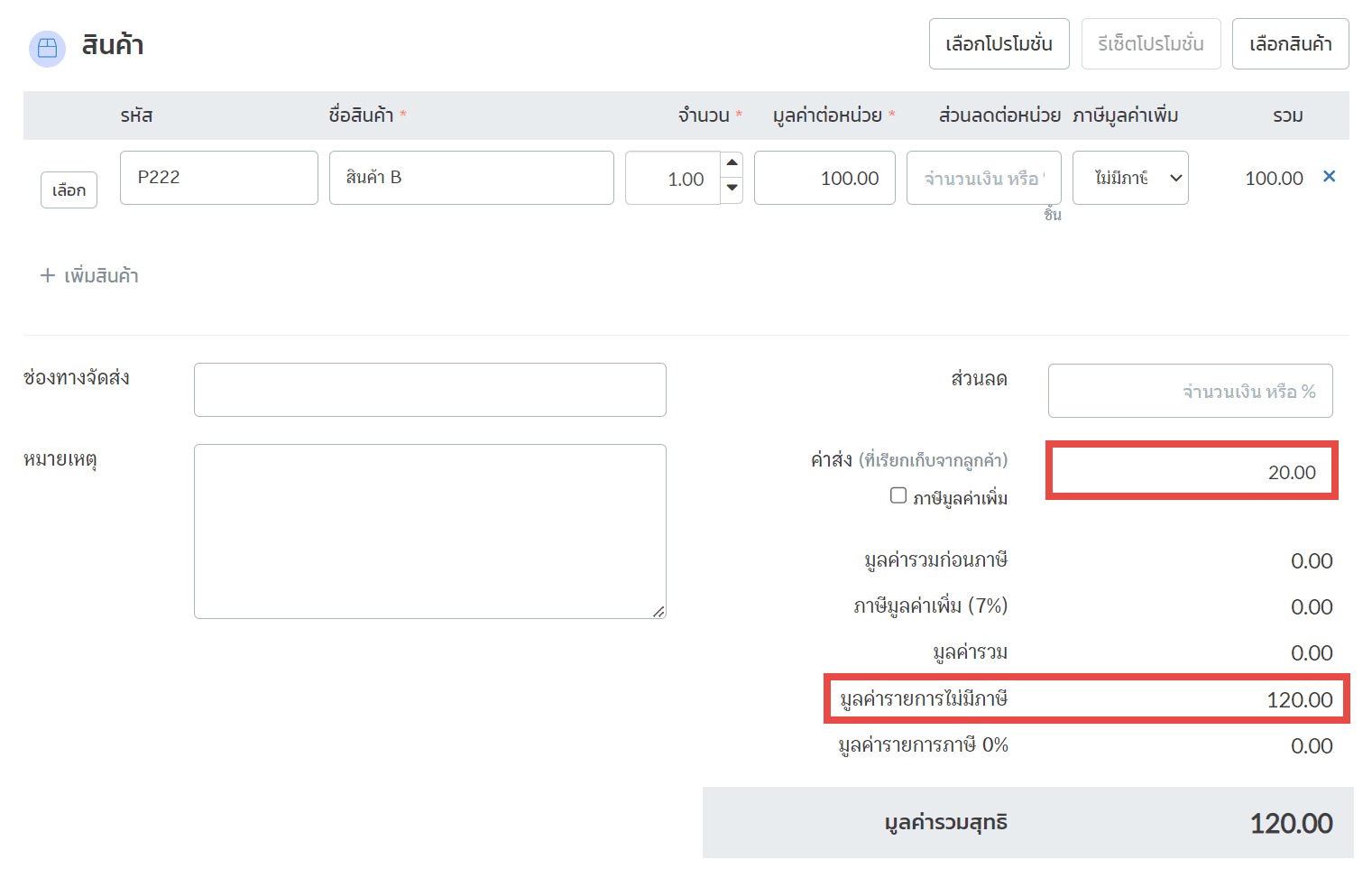

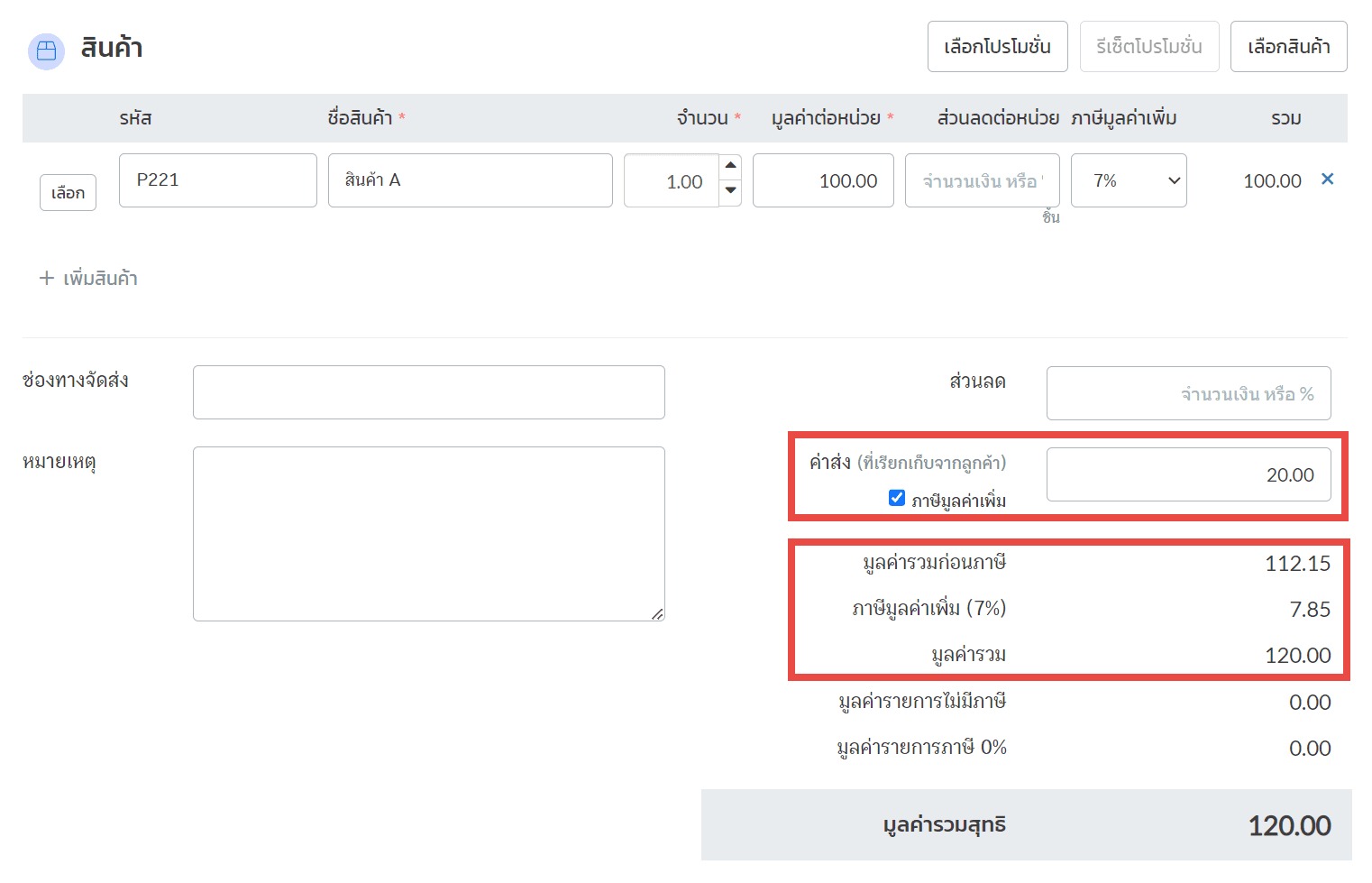

4. VAT/ NO VAT with Shipping Costs

General Shipping Costs: Added to the “Non-Taxable Value” column. E.g., Product B (100 THB) + Shipping (20 THB) = 120 THB (Non-Taxable Value = 120 THB).

Shipping Costs with VAT: Added to the VAT calculation. E.g., Product A (100 THB) + Shipping (20 THB, VAT included) = 120 THB (VAT 7% = 7.85 THB; Pre-tax value = 112.15 THB).

Example of VAT/ NO VAT on Standard Documents

Example of VAT/ NO VAT on Tax Invoice Forms

Calculating Withholding Tax for VAT/ NO VAT Transactions

When calculating withholding tax, the system computes based on the pre-tax amount. For example, Product A (100 THB, 7% VAT) will be calculated based on the total amount before tax. For non-taxable or 0% VAT items, the full amount is used for calculation.

This guideline ensures that you can effectively manage VAT and NO VAT calculations across various transaction types in your business operations.

If you are interested in utilizing our comprehensive store management system,

we encourage you to reach out for further information.

Please do not hesitate to contact us at:

Phone: 02-026-6423

Email: support@zortout.com

LINE: @zort