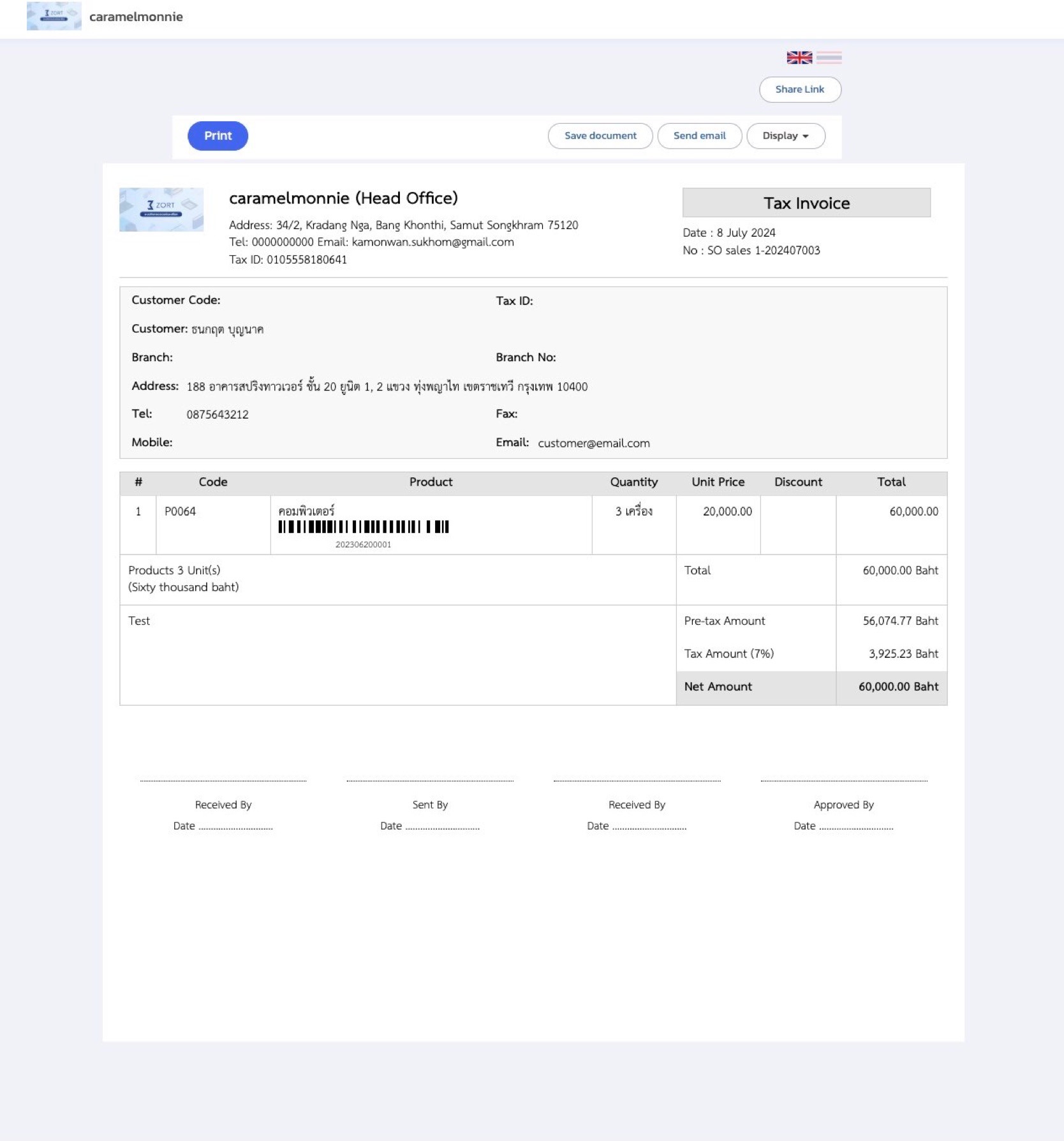

If the store needs to print a full tax invoice showing:

1. The term “Tax Invoice” clearly

2. Tax invoice number

3. Issue date (day, month, year)

4. Customer’s name, address, and ID number

5. Store’s (issuer’s) name, address, and taxpayer ID number

6. Item description, quantity, and value of goods/services

7. Value Added Tax (VAT 7%)

This can be easily managed with ZORT in 4 steps:

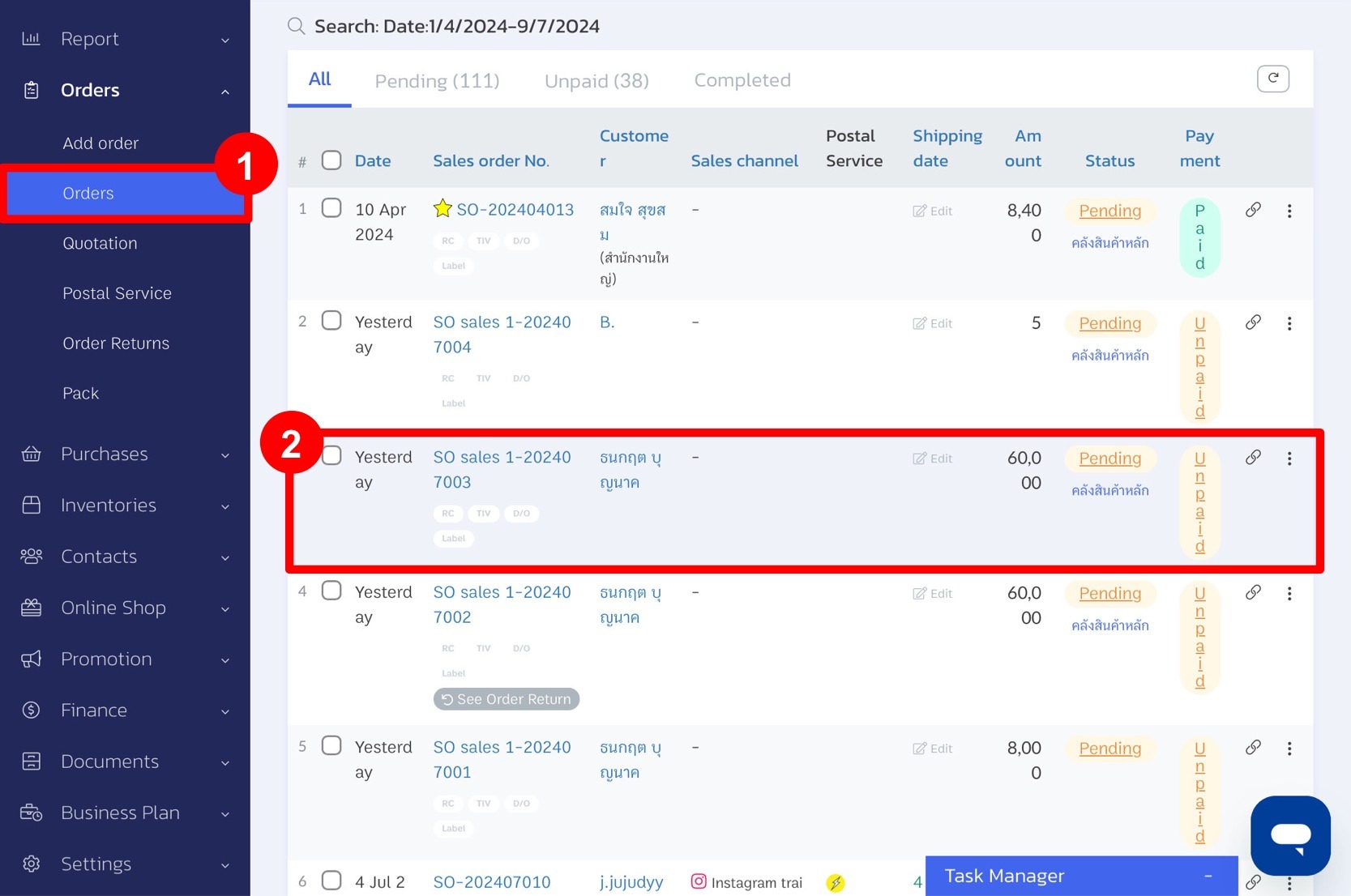

1. Go to the “Orders” menu and select “Orders”

2. Click on the order transaction.

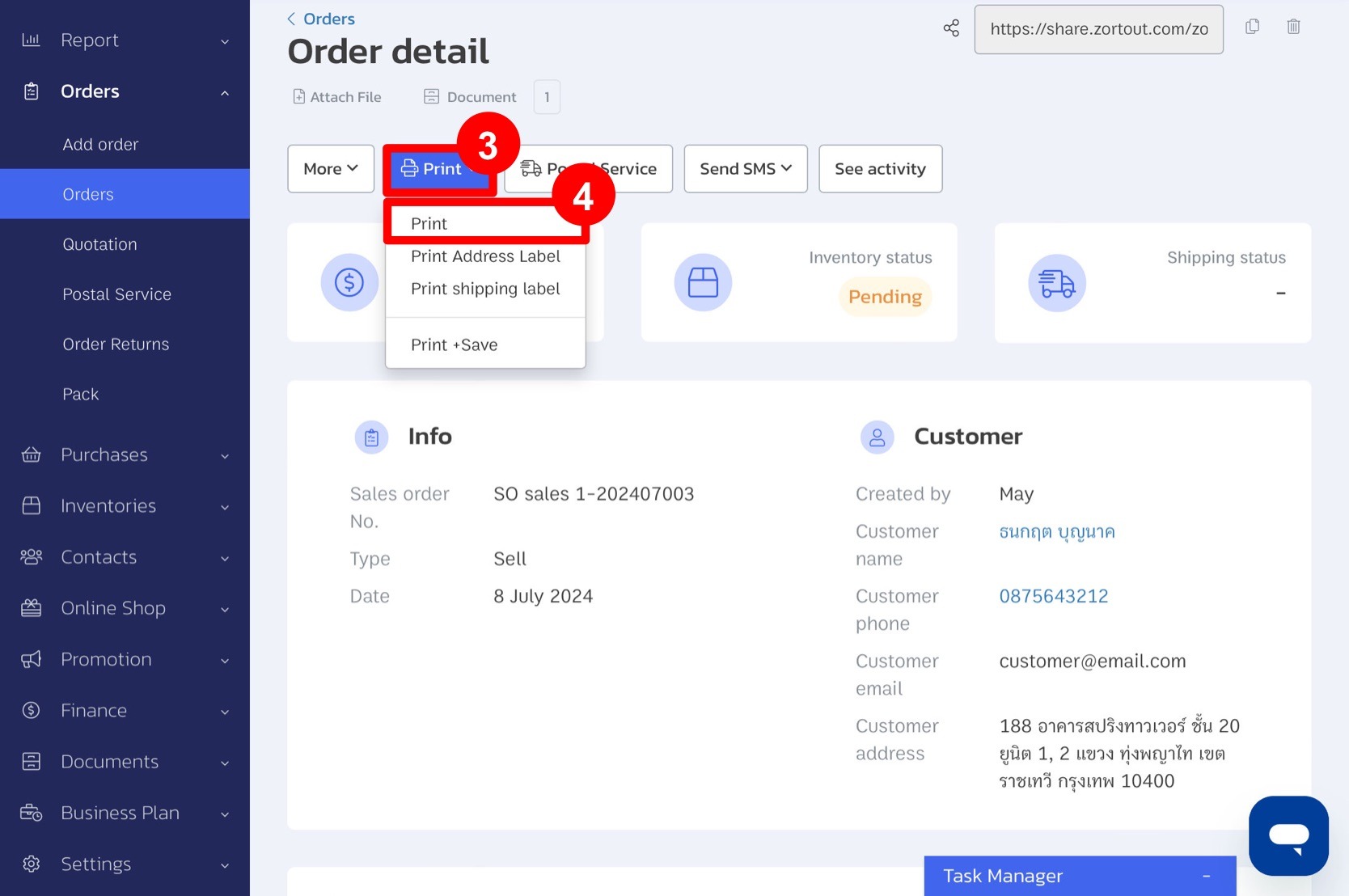

3. Click Print.

4. Select Print,

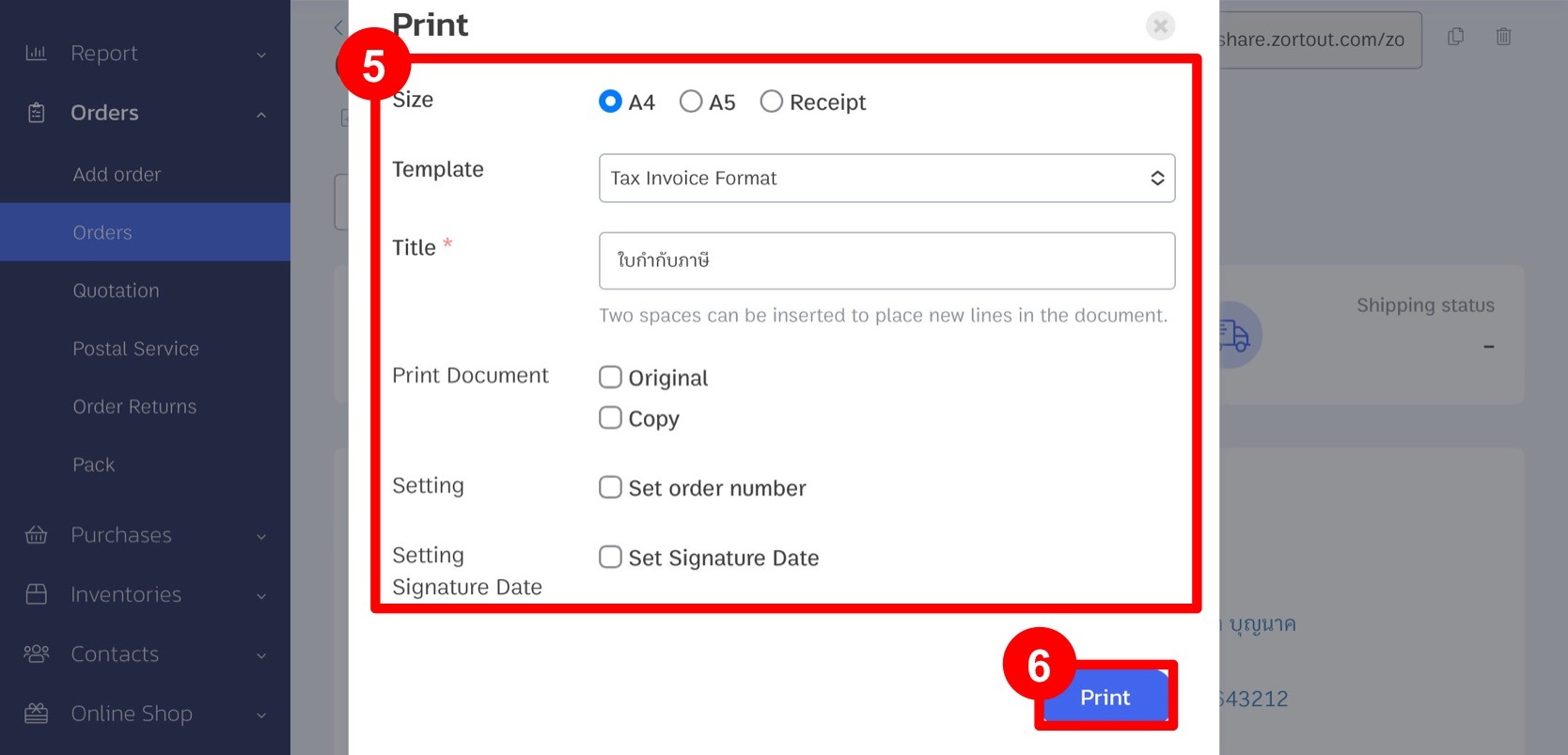

5. Choose the required size and template as “Tax Invoice Format”, and title it Tax Invoice. If needed, you can set the order number or set signature date.

6. Click “Print”.

For example the full tax invoice

If you are interested in utilizing our comprehensive store management system,

we encourage you to reach out for further information.

Please do not hesitate to contact us at:

Phone: 02-026-6423

Email: support@zortout.com

LINE: @zort