For stores using the VAT/ NO VAT add-on feature in the ZORT system, you can configure the settings in the product section to determine tax calculation. These settings will be reflected in the purchase and sales lists. Here’s how to create products with VAT and NO VAT:

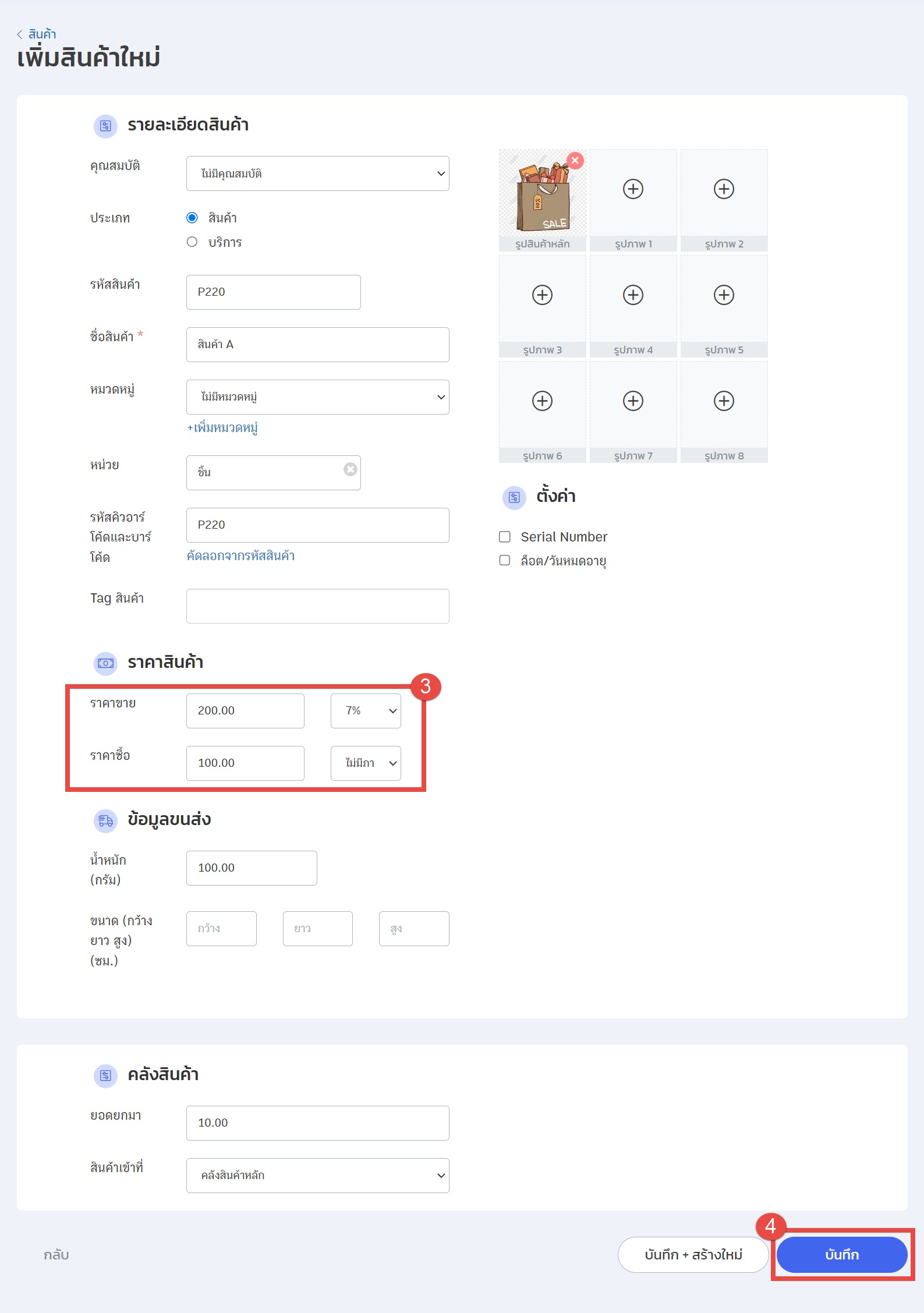

1. Go to the “Inventories” menu and select the “Products” section.

2. Click “Add Product”

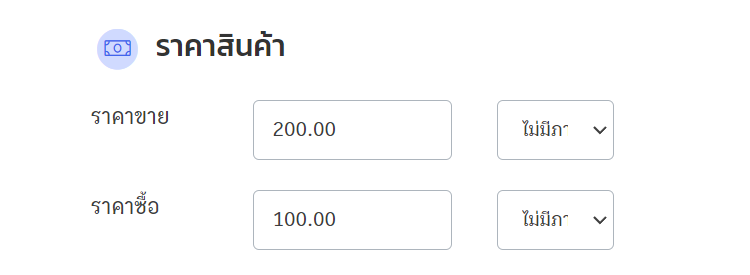

3. Complete the product details and then go to the “Sale Price/Purchase Price” section, select the tax type: No Tax, 7% VAT, or 0% VAT (For purchase price, only No Tax and 7% VAT are available).

4. Click “Save”

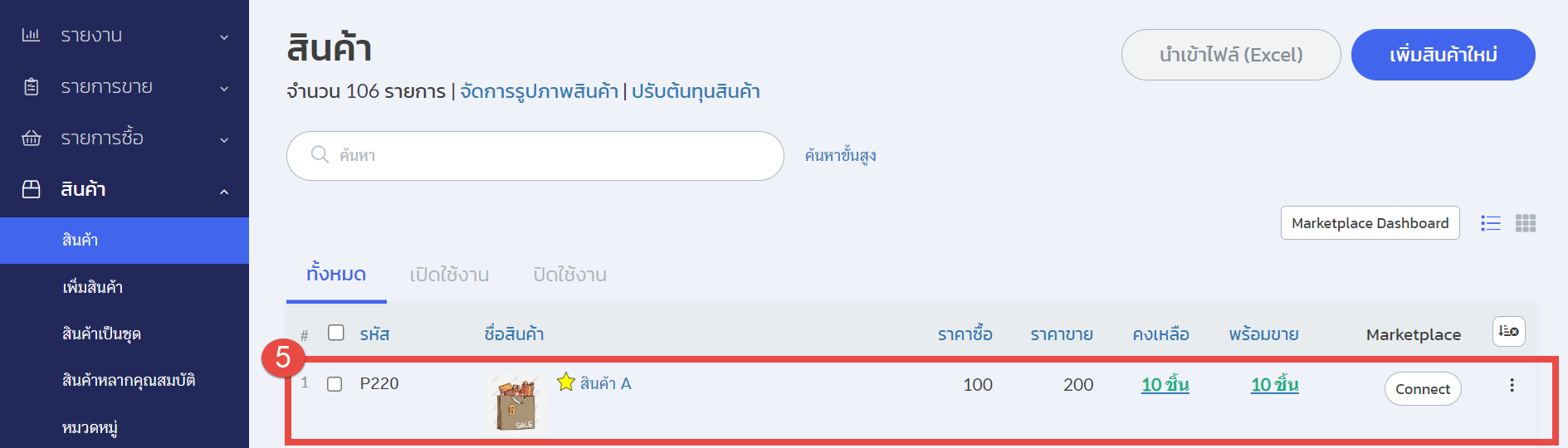

5. The system will display the newly created product in the list.

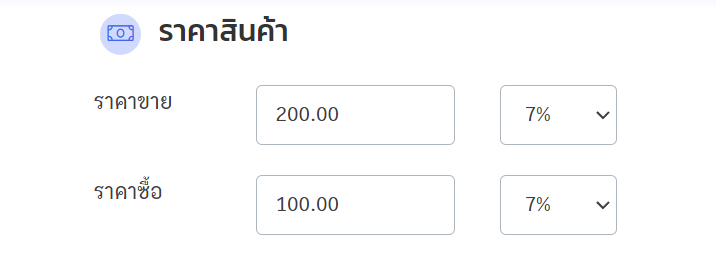

Example: Display of Products with VAT in Purchases/Orders

- Product A: Sale price 200 THB with 7% VAT, Purchase price 100 THB with 7% VAT.

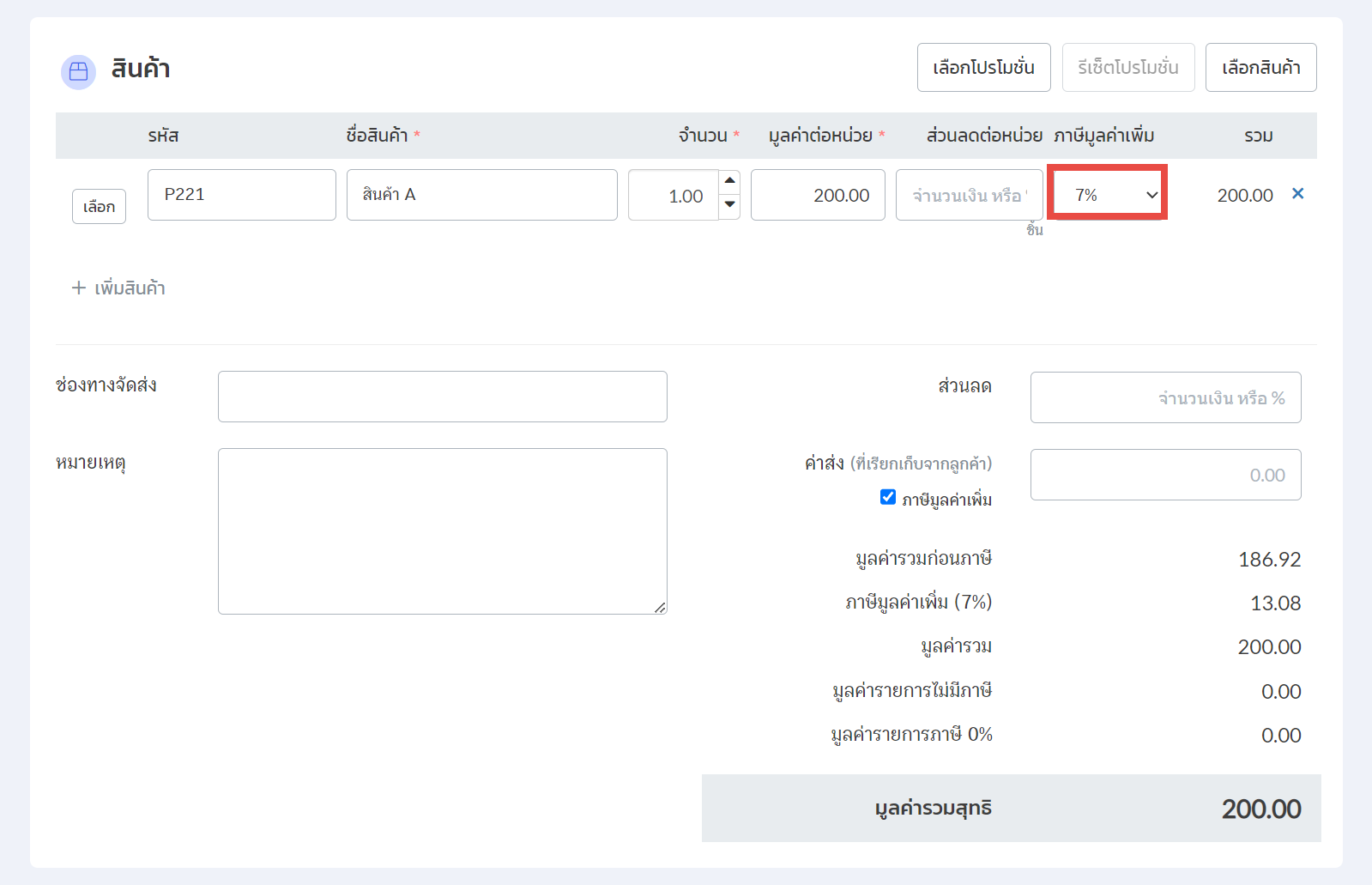

- When creating an order for Product A, the “Value Added Tax” column will automatically show “7%”.

- When creating a purchase order for Product A, the “Value Added Tax” column will also automatically show “7%”.

Product A in Orders:

Product A in Purchases:

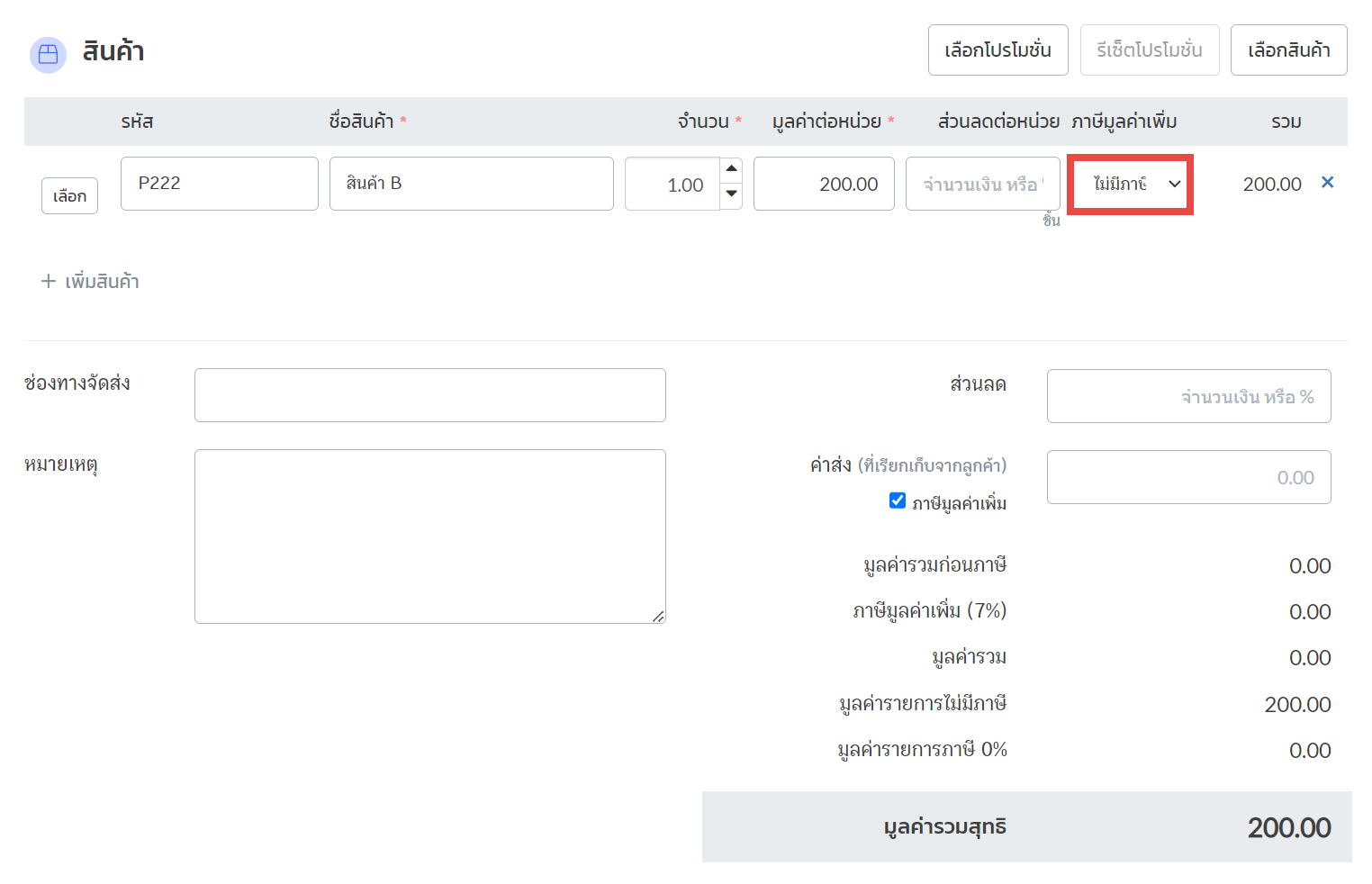

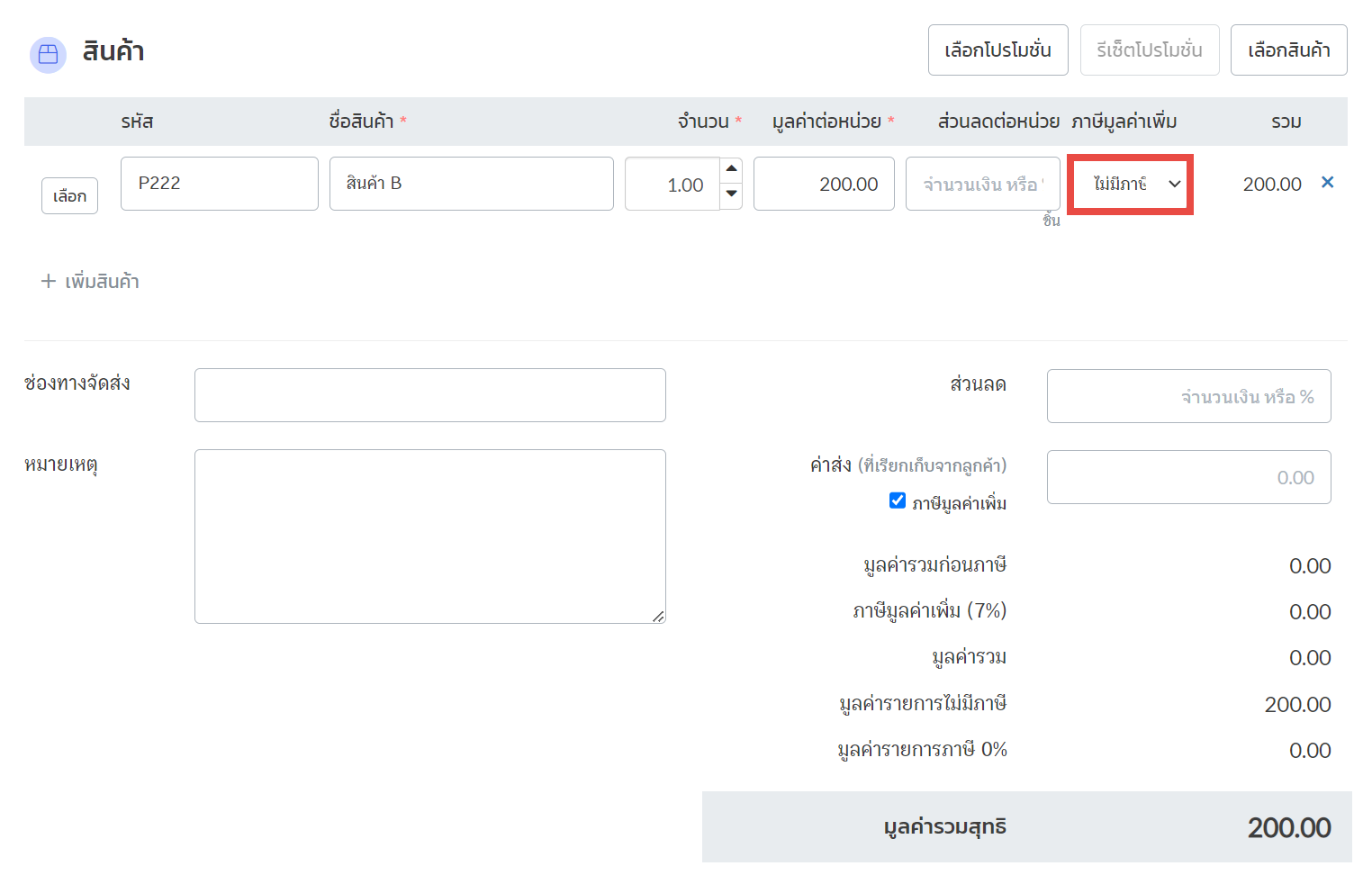

Example: Display of Products without VAT in Purchases/Orders

- Product B: Sale price 200 THB with No VAT, Purchase price 100 THB with No VAT.

- When creating an order for Product B, the “Value Added Tax” column will automatically show “No VAT”.

- When creating a purchase order for Product B, the “Value Added Tax” column will also automatically show “No VAT”.

Product B in Orders

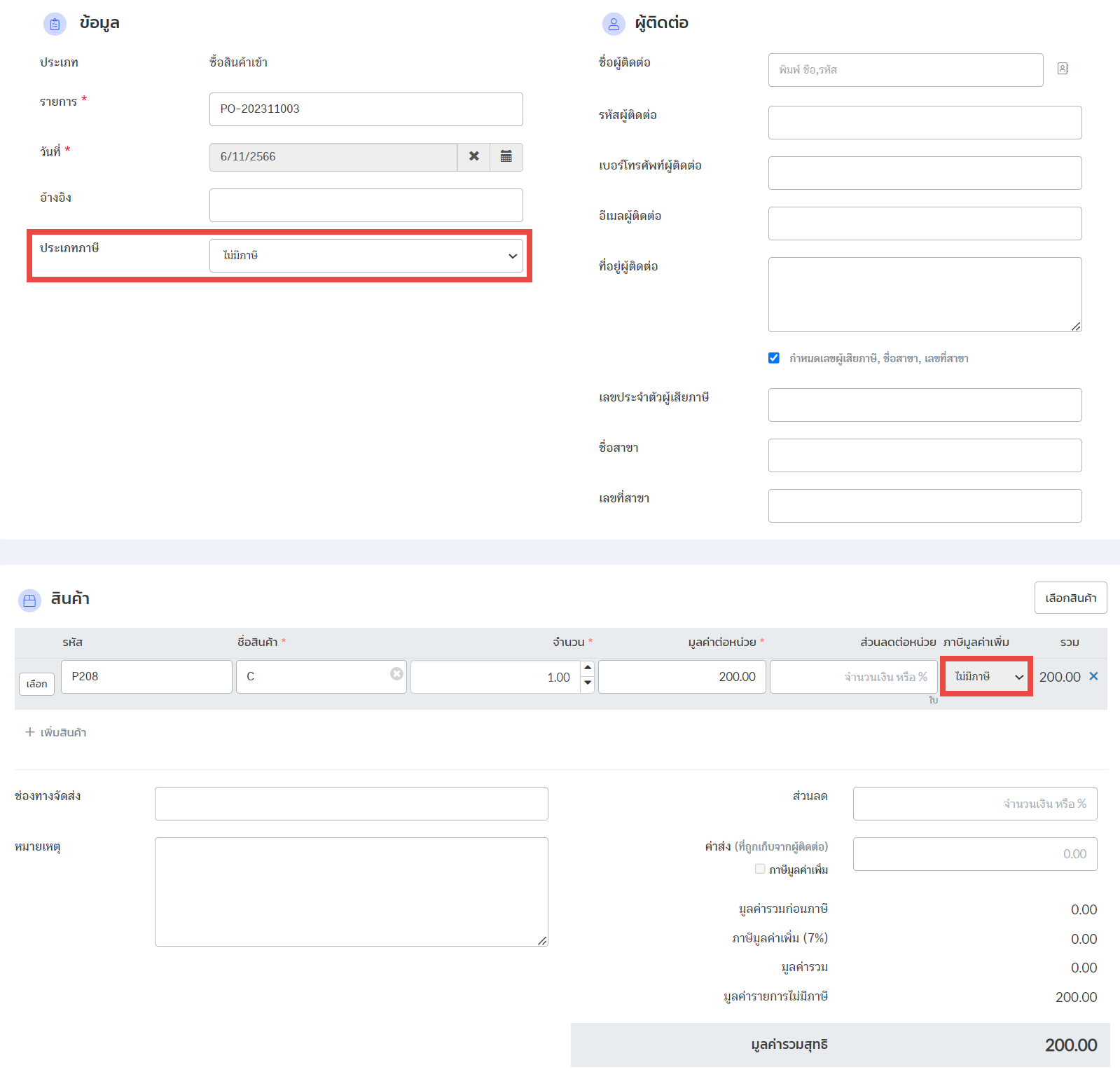

Product B in Purchases:

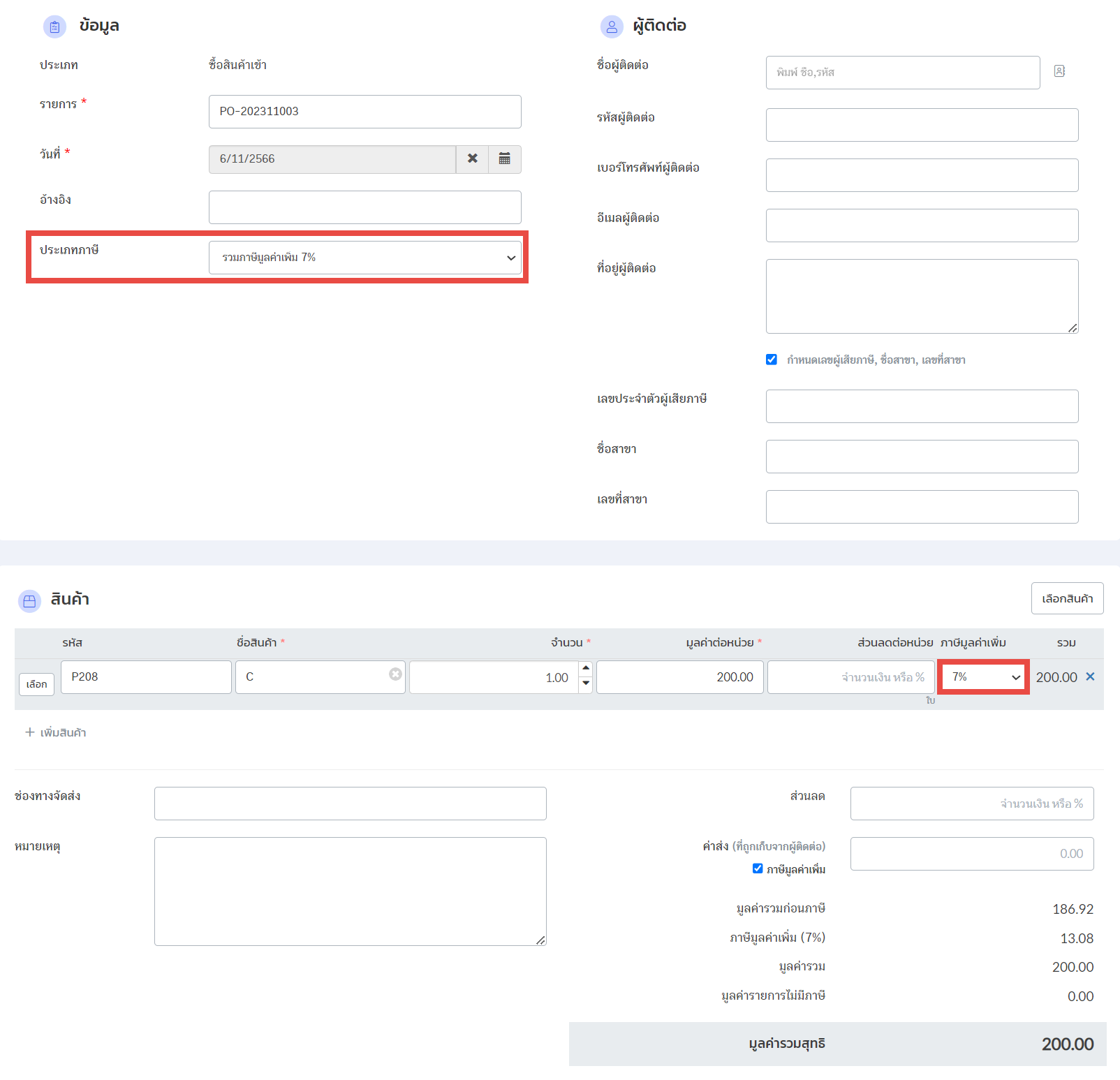

Example: Display of Products Created Before VAT/ NO VAT Function Implementation

- Product C: Created in the ZORT system before the VAT/ NO VAT function was implemented.

- When creating purchase/orders, the system will apply the tax type according to the order’s settings.

- If the order type is “Includes 7% VAT”, the product will automatically show “7%”.

- If the order type is “No VAT”, the product will automatically show “No VAT”.

Product C in Orders/Purchase with 7% VAT:

Product C in Orders/Purchase List with No VAT:

This guideline ensures that your product’s tax settings align with your business needs, providing accurate tax calculations in all transactions.

If you are interested in utilizing our comprehensive store management system,

we encourage you to reach out for further information.

Please do not hesitate to contact us at:

Phone: 02-026-6423

Email: support@zortout.com

LINE: @zort